Taming Volatile Markets: “In times of crisis, all correlations go to 1”

Fear is the mother of foresight. - Thomas Hardy

Mutiny Fund’s Jason Buck likes to say, “I can show you a picture of a snake, but if I throw a snake in your lap, you’re gonna have a very different reaction.” It’s a quote he loves, coined originally by Jason Zweig.

Buck continues1, “And everybody likes to think that when the market sells off, they’re gonna get out, they’re going to be calm, they’re going to add to their position, they’re going to buy at the lows, but that never happens.”

In today’s evolving landscape of financial markets, the give and take between asset classes such as stocks and bonds has become increasingly complex. As recent research and analyses suggest, traditional diversification strategies may fall short during times of market stress, necessitating a more nuanced approach to portfolio construction. What’s more, in this piece, we explore how integrating cash, long-volatility strategies, and tail risk protection into portfolios can offer investors a more resilient framework, better suited to weather market turbulence and provide opportunities for successful rebalancing.

A long-volatility strategy is a sophisticated, and now accessible, investment approach that aims to capitalize on and profit from periods of increased market volatility or heightened economic uncertainty, typically by utilizing financial instruments or allocation methods that gain value when market turbulence rises, thus potentially serving as both a hedge against market downturns and an opportunity for significant returns during times of financial stress.

A tail-risk investment strategy is a sophisticated, and now accessible, approach designed to protect a portfolio against extreme market events or "black swan" occurrences that can lead to catastrophic losses. This strategy focuses on hedging against low-probability, high-impact scenarios that lie in the "tails" of the normal distribution of returns, typically using options, derivatives, or other financial instruments to provide a form of insurance against severe market downturns while still allowing for participation in potential market gains.

“We’ve all lived through 2007, 2008. And so having these structurally in your portfolio can provide you with these convex cash positions, that you can deploy into your lower NAV positions, opportunistically,” says Buck.

One of the key challenges in modern portfolio management is the behavior of asset correlations during crises. As Howard Marks of Oaktree Capital Management aptly notes2 in his most recent missive, "In times of crisis, all correlations go to 1." This observation underscores a critical vulnerability in traditional diversification strategies: when it is most needed, the supposed diversification benefit of holding a mix of asset classes can evaporate, as all assets move in the same direction. This phenomenon was observed during the financial crises of 2008 and 2020, where both stocks and bonds experienced simultaneous declines, leaving investors with fewer places to hide.

The BofA Systematic Flows Monitor echoes this sentiment, noting how "trend followers are likely closer to neutral for now" but are expected to continue adding to UST (U.S. Treasury) longs3. This behavior suggests that large-scale positioning by institutional investors can further exacerbate correlations between asset classes, particularly during periods of heightened market stress. The same report indicates that "bonds the likely winner if 'hard' [recession]," reinforcing the idea that bonds might outperform equities in severe downturns, but… not without risk. While bonds may be the likely winner in the period ahead, where does that leave stocks and other equity like assets?

Equity Armor’s Luke Rabhari concurs4 with BofA that large-scale (re)positioning by institutional investors can further exacerbate correlations: "Volatility from every asset class will bleed into other asset classes. The only question is, how fast and how much, and if you’re just trading equities, and if you don’t care about FX volatility, and if you don’t care about fixed income volatility, you’re gonna get kicked in the face."

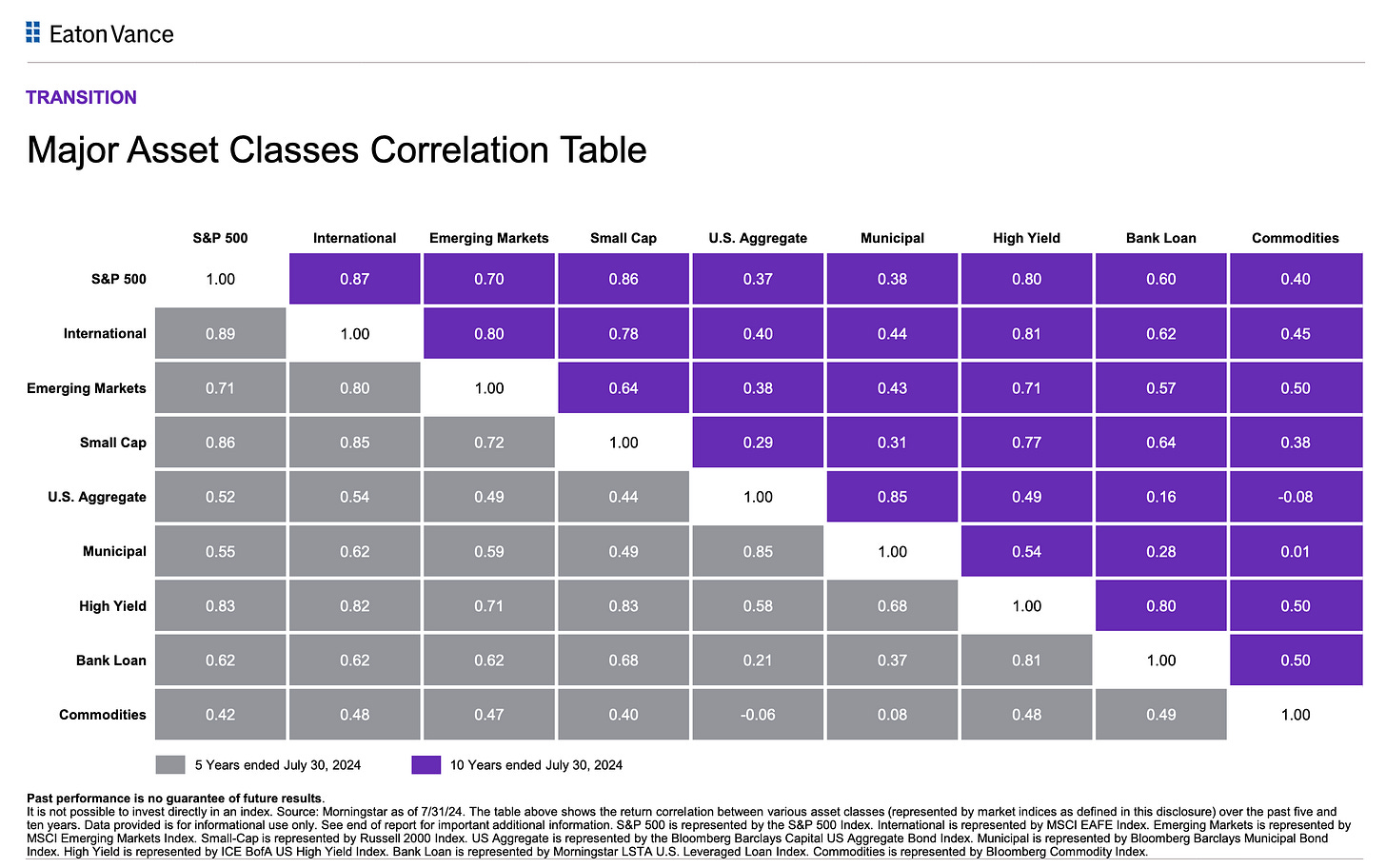

Yet, even as bonds traditionally serve as a hedge against equity downturns, this relationship is not foolproof – it is not adequate. The Beat report from Eaton Vance this month highlights that while the correlation between U.S. stocks and bonds is generally low, it is not entirely negative.5 "The table above shows the return correlation between various asset classes... over the past five and ten years," with the correlation between U.S. stocks (S&P 500) and U.S. bonds (U.S. Aggregate) being positive but relatively low. This suggests that while bonds can provide some diversification, they may not always offset losses in equities, especially in extreme market conditions.

Given these insights, the introduction of cash, long-volatility, and tail risk strategies into a portfolio becomes not just a prudent choice but a necessary one. Cash, often overlooked in favor of more aggressive growth strategies, offers immediate liquidity and a buffer against market drawdowns. As HSBC Stephen Major in his Major Bond letter highlights, bonds are ideally supposed to "act as the hedge in a portfolio," but their effectiveness can vary depending on market conditions6. Cash, in contrast, does not carry the same market risk and can be deployed opportunistically when markets decline, allowing investors to rebalance into undervalued assets. But holding larger cash allocations has its limitations as well. While cash can now provide interest income, and more importantly, allow you to invest opportunistically when markets are in stress, the odds you’ll be able to make that decision, behaviourally speaking, at the right moment tend to dwindle as markets sink.

Long-volatility strategies, on the other hand, which aim to profit from periods of market stress when volatility spikes, can provide another significant layer of protection, beyond holding straight cash – these strategies would be implemented within the ‘Cash’ quadrant of a portfolio based on Harry Browne’s Permanent Portfolio.

Before we continue here, let’s look at the basis for this thoughtful and actionable approach to portfolio construction. In 1972, Browne came up with the Permanent Portfolio advocating 4 equal portfolio shares in stocks for Growth, bonds for Disinflation and Deflation, Cash for periods of market Decline, and Gold for Inflation protection. This model portfolio framework was subsequently adopted and modified by the likes of Ray Dalio (Bridgewater), and many other sophisticated investors since. Coupled with periodic rebalancing back to the 4 equal parts, this strategy has proven time and again to mitigate risk through all market cycles and drawdown events, and, most important of all, produce enviable long-term returns and resilience for its practitioners’ portfolios. Of course, it goes without saying that it’s up to you, the investor or investment professional, to decide on how to run your portfolios. You’re free to decide how to use this simplified framework as a guide in your critical thinking.

These volatility strategies are designed to perform well, and with convexity when traditional assets falter, offering gains that can offset losses in stocks and bonds. The BofA Systematic Flows - CTAs report supports this approach by discussing how "risk parity strategies... maintain a high correlation between their performance and broader market indices," suggesting that even well-diversified portfolios can benefit from strategies that specifically target volatility.

Jason Buck and Taylor Pearson of Mutiny Fund emphasize the importance of incorporating long-volatility and tail risk strategies into investment portfolios. Buck states, "Our long volatility and tail risk allocation is a ballast against your stocks and bonds," highlighting the challenge of balancing these strategies with traditional assets7. They point out the limitations of traditional diversification, noting, "Traditional diversification fails when you need it most," during periods of market stress.

Tail risk protection strategies, which focus on extreme, unlikely events (so-called "black swans"), further bolster a portfolio's resilience. By hedging against catastrophic market declines, these strategies ensure that portfolios remain intact even in the face of severe market dislocations. Buck elaborates on the role of tail risk strategies, describing them as akin to buying deep out-of-the-money put options, which serve as insurance against significant market downturns. He explains, "You buy put options, say, with a negative 20% attachment point," providing coverage during severe market declines.

Incorporating cash, long-volatility, and tail risk strategies into a portfolio is not just about protecting against downside risk; it also enhances the ability to rebalance portfolios more effectively. During market sell-offs, these strategies can generate positive returns or preserve capital, providing the liquidity needed to buy undervalued assets at depressed prices.

Zed Francis, CIO and Co-Founder at Convexitas8 says "Our view of utilizing the tool [volatility] is to utilize it within your portfolio to create liquidity during nasty events. And that gives you the opportunity to utilize that liquidity to accumulate additional assets for the long haul."

Jason Buck says, "If you don’t have portfolio insurance, you don’t have a portfolio [Nassim Taleb]. This is about going back to the behavioral aspects of it... having these [strategies] structurally in your portfolio can provide you with (asymmetric) cash positions [during market downturns] for investment, and more importantly, from a behavioral standpoint, keep you from having to do anything stupid at an inopportune moment."

Adding long-volatility, and tail risk protection strategies into investment portfolios is a strategic response to the evolving dynamics of asset correlations and market behavior. By acknowledging the limitations of traditional diversification—especially in times of crisis—and considering the thoughtful use of these additional strategies, investors and practitioners can build more resilient portfolios. This approach not only mitigates potential losses during market downturns but also positions investors to take advantage of opportunities when they arise, leading to more successful portfolio rebalancing and, ultimately, better long-term outcomes.

Long-volatility strategies can be implemented through various means:

Long Volatility ETFs: These exchange-traded funds are designed to increase in value when market volatility rises. They often track volatility indexes like the VIX (CBOE Volatility Index)9.

Options Trading: Purchasing options, particularly puts, allows investors to profit from an increase in volatility or a decline in the underlying asset's price.

Derivatives: Using instruments like volatility futures or variance swaps to gain direct exposure to volatility10.

Asset Allocation: Some strategies involve flexible and quantitative allocation using statistical tools to adjust exposure to equity market volatility11.

Here are four main ways tail risk strategies can be implemented:

Options-Based Strategies:

Protective Put Options: Purchasing out-of-the-money (OTM) put options on equity indices or individual stocks12.

Collar Strategies: Buying OTM put options while simultaneously selling OTM call options to finance the puts.

Volatility-Based Approaches:

VIX Futures: Using VIX futures to capitalize on the negative correlation between volatility and equity returns13.

Long Volatility ETFs: Investing in exchange-traded funds designed to increase in value when market volatility rises.

Asset Allocation and Diversification:

Low Volatility Equity: Investing in stocks with lower historical volatility.

Risk Parity: Allocating assets based on risk contribution rather than capital allocation.

Diversification across uncorrelated alternative investments14.

Dynamic Risk Management:

Trend Following: Using quantitative models to adjust exposure based on market trends.

Equity Exposure Management: Dynamically adjusting equity exposure based on various market indicators.

Volatility Management: Actively managing portfolio volatility to control risk.

These strategies can be used individually or in combination to create a comprehensive tail risk management approach tailored to an investor's specific needs and risk tolerance.

*****

This article is not to be considered as advice. Use your own judgment, consult experts, and make decisions that are right for you!

Footnotes:

rcm-alternatives. "Volatility as an Asset Class with Jason Buck, Zed Francis, Rodrigo Gordillo, and Luke Rahbari." RCM Alternatives, 24 Feb. 2023, https://www.rcmalternatives.com/2023/02/volatility-as-an-asset-class-with-jason-buck-zed-francis-rodrigo-gordillo-and-luke-rahbari.

Howard Marks, Mr. Market Miscalculates, August 22, 2024, https://iando.s3.ca-central-1.amazonaws.com/mr-market-miscalculates.pdf

BofA, Trend follower bond longs getting stretched, equity closer to neutral for now, August 16, 2024, https://iando.s3.ca-central-1.amazonaws.com/BofA_Systematic+Flows+Monitor+Trend+follower+bond+longs+getting+stretched%2C+equity+closer+to+neutral+for+now_20240816.pdf

Luke Rahbari, Equity Armor, rcm-alternatives. "Volatility as an Asset Class with Jason Buck, Zed Francis, Rodrigo Gordillo, and Luke Rahbari." RCM Alternatives, 24 Feb. 2023, https://www.rcmalternatives.com/2023/02/volatility-as-an-asset-class-with-jason-buck-zed-francis-rodrigo-gordillo-and-luke-rahbari.

Eaton Vance, The Beat, August 2024, https://iando.s3.ca-central-1.amazonaws.com/The+BEAT+-+August+2024.pdf

Stephen Major, HSBC, The Major bond letter, #turningpoints, August 14, 2024, https://iando.s3.ca-central-1.amazonaws.com/HSBC_The+Major+bond+letter52Turning+points_20240814.pdf

Jason Buck, Taylor Pearson, Mutiny Fund, Mutiny Fund. "About." Accessed August 24, 2024, https://mutinyfund.com/about/

Zed Francis, Convexitas, rcm-alternatives. "Volatility as an Asset Class with Jason Buck, Zed Francis, Rodrigo Gordillo, and Luke Rahbari." RCM Alternatives, 24 Feb. 2023, https://www.rcmalternatives.com/2023/02/volatility-as-an-asset-class-with-jason-buck-zed-francis-rodrigo-gordillo-and-luke-rahbari.