The Art of Patient Diversification: Lessons from Meketa and Mutiny

Patience is not simply the ability to wait - it's how we behave while we're waiting. – Joyce Meyer

by Pierre Daillie, Managing Editor, AdvisorAnalyst.com

Investing is a balancing act, a constant tension between risk and reward, fear and greed, offense and defense. Two distinct voices in the investment world—Mutiny Fund’s Jason Buck and Taylor Pearson, and Meketa’s Frank Benham and Lauren Giordano—approach this balancing act with a common theme: patience and diversification are paramount. Yet, they arrive at this conclusion from different directions, offering complementary insights into how investors can best position themselves for long-term success. While Mutiny Fund focuses on the protective power of volatility-based strategies, Meketa champions diversification and the avoidance of behavioral pitfalls in constructing resilient portfolios.

At the core of both approaches is the recognition that markets move in cycles. As Meketa’s team highlights, “financial markets tend to move in cycles that can dramatically affect asset performance”. This isn’t a novel observation, but the length and unpredictability of these cycles make it difficult for many investors to ride out the ups and downs. Patience, as Meketa argues, is key to withstanding these cycles, especially when certain asset classes—such as U.S. equities in recent years—seem to outperform everything else. The temptation to abandon diversification in favor of recent winners is strong, but ultimately dangerous. “Diversification,” the report insists, “helps mitigate the risks associated with these cycles by not relying on specific market conditions”.1

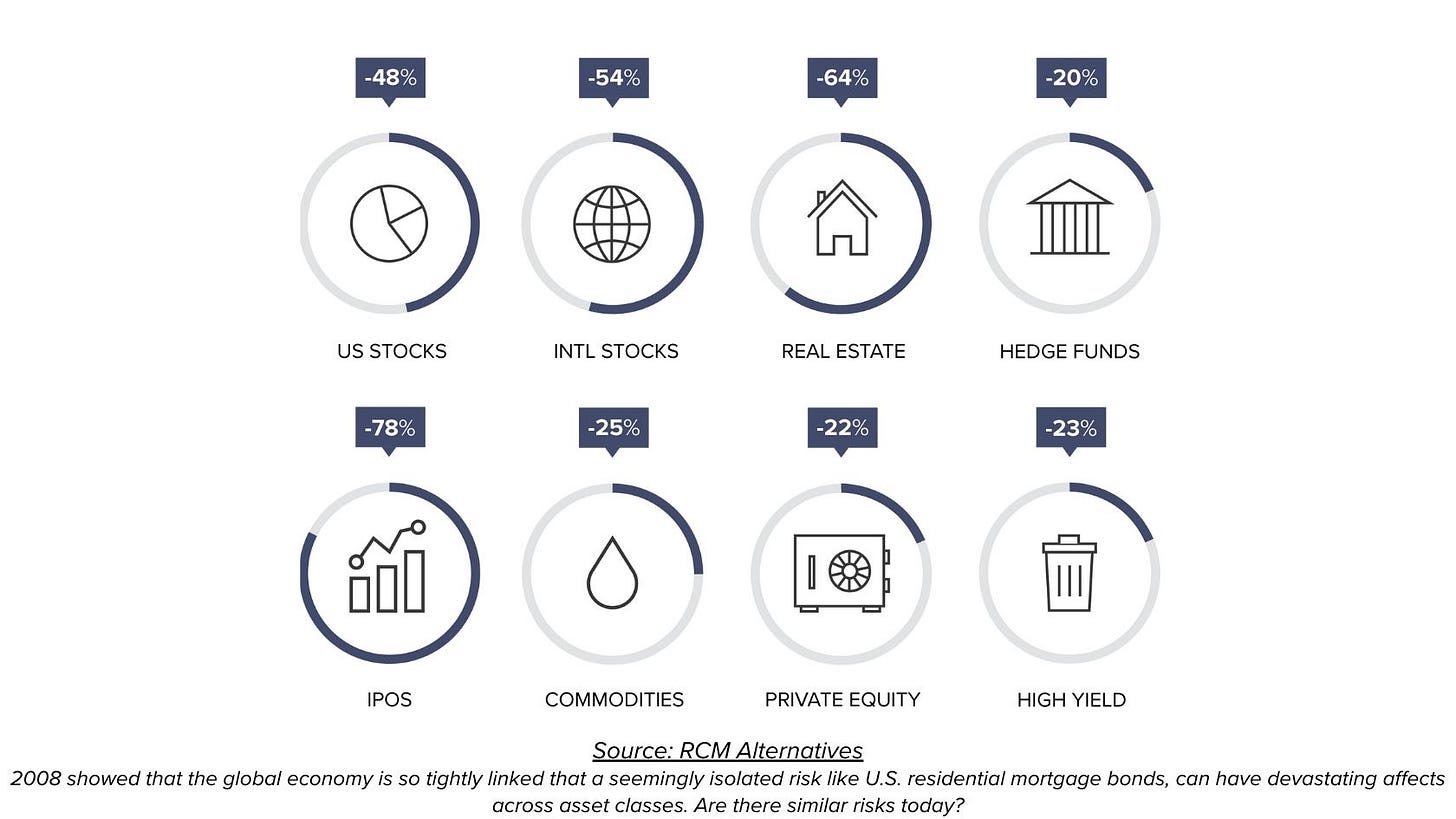

Similarly, Buck and Pearson of Mutiny Fund take a broader view of diversification, arguing that many traditional portfolios are overly reliant on offensive assets—stocks and bonds—while underweighting defensive strategies such as long volatility and trend-following.2 Their approach, informed by the lessons of the 2008 financial crisis, is a direct response to the failure of supposedly diversified portfolios that imploded when markets tanked. “In 2008, a seemingly ‘diversified’ portfolio of U.S. stocks, international stocks, real estate, commodities, and high yield bonds turned out not to be so diversified,” they note.

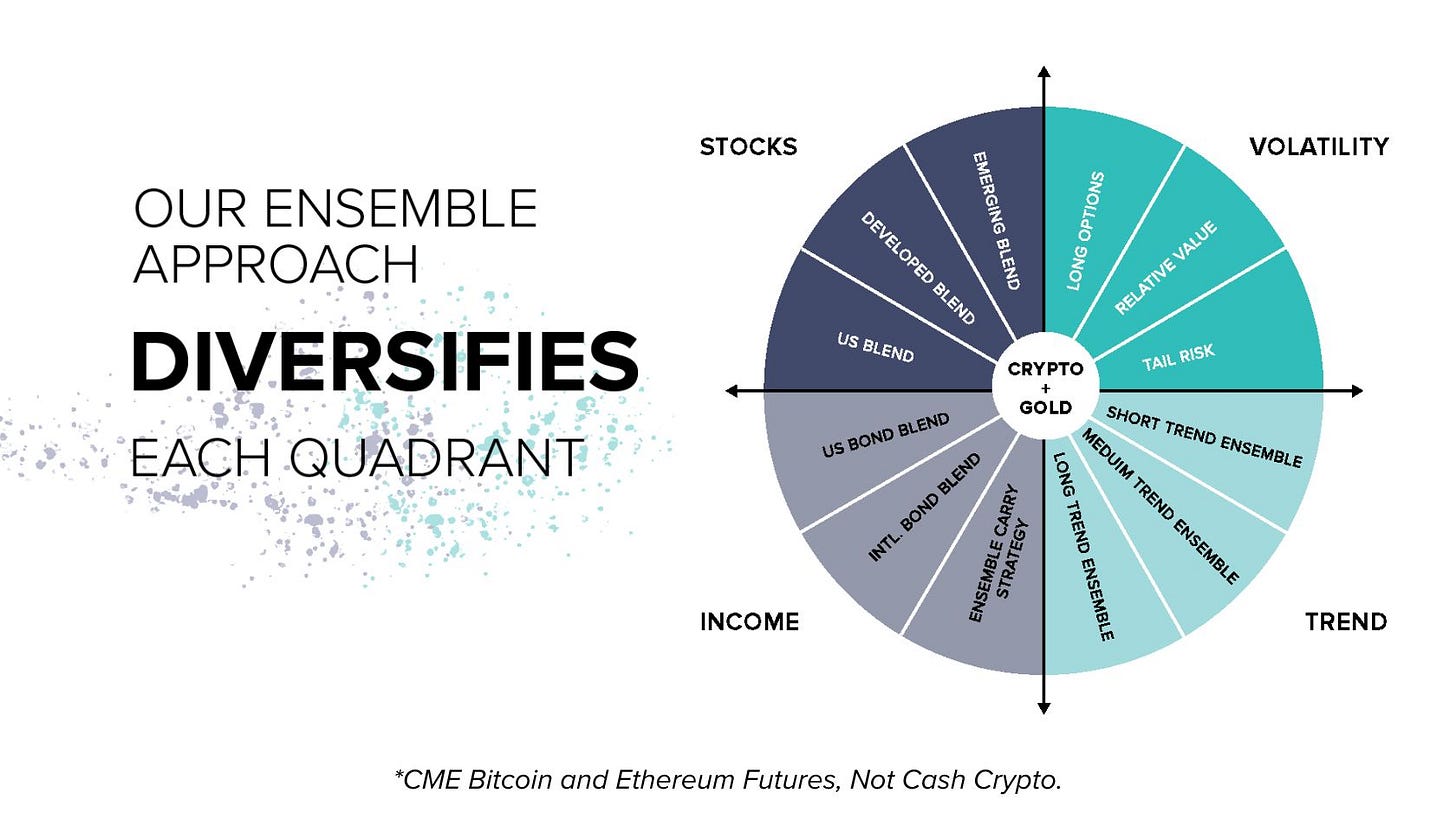

Their solution? The Cockroach Portfolio, a modern twist on Harry Browne’s Permanent Portfolio, which includes not only stocks and bonds but also long volatility strategies and trend-following.

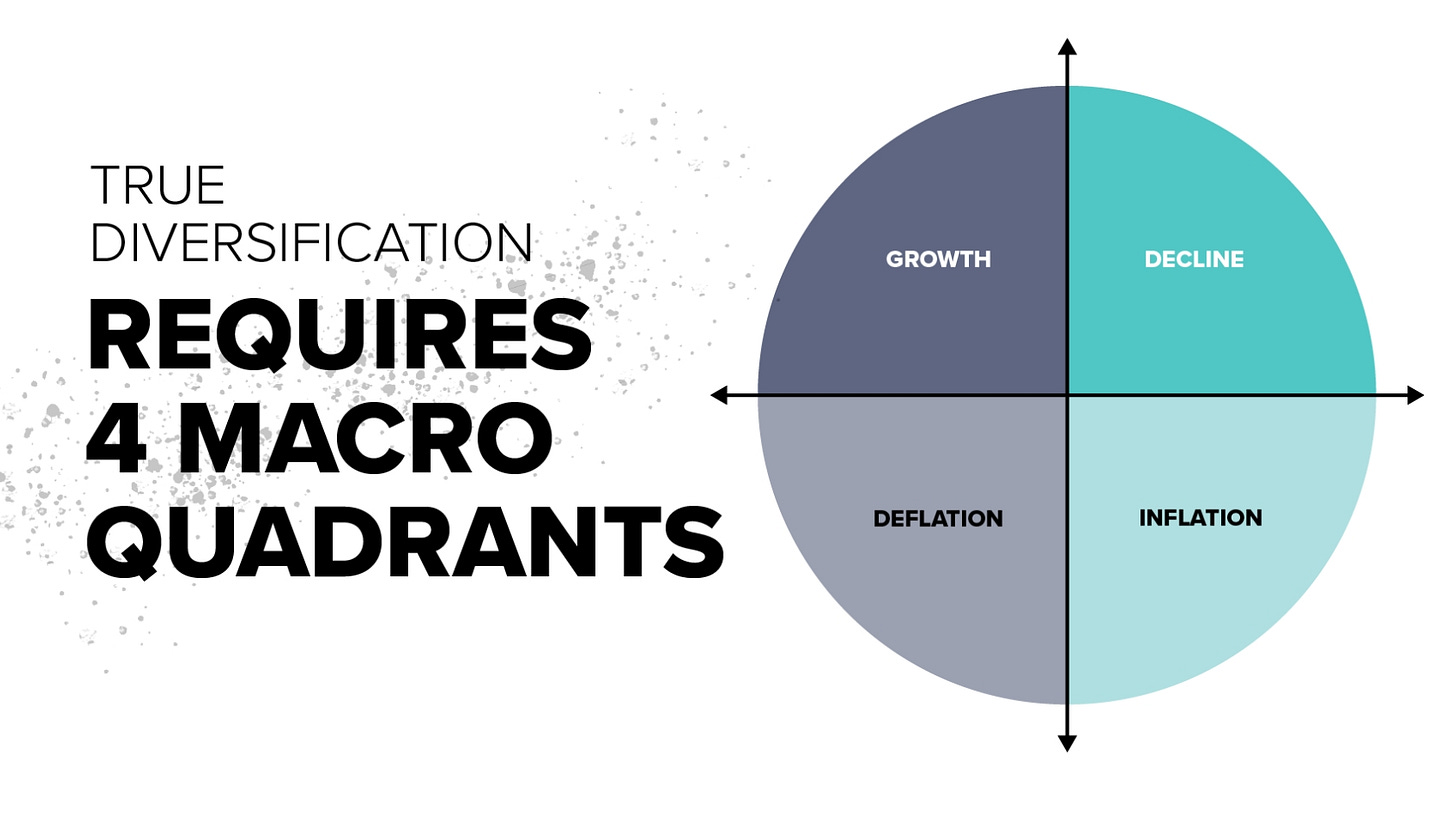

These components, they argue, allow the portfolio to survive in various economic environments: growth, recession, inflation, and deflation.

Jason Buck and I talked about this during the summer on Insight is Capital - hearing it straight from him might help you understand why I can’t seem to stop thinking about this topic.

Meketa and Mutiny Fund both emphasize is the importance of avoiding short-term thinking. Meketa’s whitepaper is rife with examples of behavioral biases that lead investors astray, such as endpoint bias and performance chasing. As they explain, “placing undue significance on recent events and extrapolating the recent past into the future can lead to poor investment decisions”. The tech boom of the late 1990s, followed by the dot-com crash, offers a perfect illustration of this phenomenon: at the height of the bubble, growth stocks appeared unbeatable, but within a year, their dominance had collapsed. Investors who chased performance suffered enormous losses, while those who remained diversified were better positioned to recover.

Mutiny Fund echoes this sentiment but takes it a step further, arguing that traditional diversification methods are not enough. Their use of long volatility strategies—a relatively obscure approach to most retail investors—acts as both a hedge against market crashes and a tool for seizing opportunities when others are selling. As they explain, “holding cash dampens the drawdowns in the rest of the portfolio, but long volatility strategies seek to not just dampen the drawdown but to generate profits in a sharp sell-off”. This active approach to volatility contrasts with more passive methods of diversification, but the underlying philosophy is the same: protect the downside while maintaining exposure to upside potential.

Both Meketa and Mutiny Fund emphasize the cyclicality of markets and the dangers of assuming current trends will continue indefinitely. Meketa points out that market leadership tends to rotate, often unpredictably: “reversals/rotations in market leadership are often not widely anticipated in advance,” and attempting to time these shifts is “difficult, risky, and even dangerous”. Mutiny Fund, on the other hand, focuses on the different economic environments that investors must navigate. Their Cockroach Portfolio is designed to perform well across various macroeconomic conditions, rather than betting on one or two to persist. This is where their defensive strategies shine—long volatility thrives during market crashes, while trend-following can capture gains in more stable environments. In a word, structurally defensive investments act as a moat, to neutralize against violent attacks–the kind that wreaked havoc on markets in 2007-2009, and more recently in 2020, and 2022.

Another important theme shared by both sources is the need for patience in the face of underperformance. Investors often lose faith in diversification when certain asset classes underperform for extended periods, but both Meketa and Mutiny Fund argue that sticking with a long-term strategy is crucial. Meketa’s report underscores the idea that asset classes in a slump often rebound over time, and that patience usually allows investors to ride out the volatility and potentially benefit from long-term growth. Likewise, Mutiny Fund advocates for staying the course with defensive strategies, even when they appear to drag on returns during bull markets, because their true value is realized during crises.

The ultimate key to either diversification strategy is to rebalance. In the case of Mutiny’s strategy, during more violent outsized drawdowns, the long volatility component is there to provide outsized returns, and thus outsized cash positions, call it insurance, putting the investor in a position to deliberately and systematically re-allocate or rebalance across bombed-out equity, fixed income and trend positions. Trend-following positions offer a return streams uncorrelated to stocks and bonds that can protect against periods of inflation and rate volatility, and which would also get sytematically rebalanced into the other three quadrants. The substantial benefit to investors of taking this ‘defensive’ approach, over longer stretches of time, enables investors to reap even greater rewards from what is commonly referred to as ‘rebalancing alpha,’ which significantly improves or smoothes the returns, and improves period-to-period compounding of wealth.

In essence, both Meketa and Mutiny Fund advocate for a form of diversification that goes beyond just mixing stocks and bonds. Meketa focuses on building diversified portfolios to smooth out market fluctuations and reduce reliance on specific market conditions. Mutiny Fund, on the other hand, emphasizes layered diversification, which includes traditional assets alongside more defensive strategies like long volatility and trend-following. The goal for both is the same: to maximize long-term returns while minimizing short-term risks.’

In sum, what both perspectives remind us is that the future is uncertain, markets are volatile, and chasing short-term trends is a recipe for disappointment. Whether through traditional diversification or more sophisticated strategies like long volatility, the key is to build a portfolio that can withstand the unexpected. As Buck and Pearson put it, “offense wins games, but defense wins championships”. And in the game of investing, it’s the championship that counts.

At the end of the conversation I had with Jason (listen to it), Jason shares this thought:

I would like to go back to like a pre-1980s, when you didn't have your portfolio on your phone. The average Robin Hood person checks their portfolio eight times a day. How is that helpful to you? So if you have a properly diversified portfolio of offensive and defensive assets, et cetera, you can forget about those savings. And you can go back to your daily life and enjoy spending time with your family, with your friends, doing your hobbies, whatever work you love. This whole thing that investing in our portfolios is like front and center in our lives–I think is, is really sad to me. That's what I'm trying to get at.

I hope people watch this and then never watch another show again about investing, right? Go back and enjoy your lives, enjoy your families.

Great advice! Thank you for reading this, and take care until next time.

Frank Benham and Lauren Giordano. "The art of patient investing - Meketa Investment Group." Meketa Investment Group, 28 Sept. 2024, https://meketa.com/leadership/the-art-of-patient-investing.

Jason Buck and Taylor Pearson. "About - Mutiny Fund." Mutiny Fund, 17 Sept. 2024, https://mutinyfund.com/about.